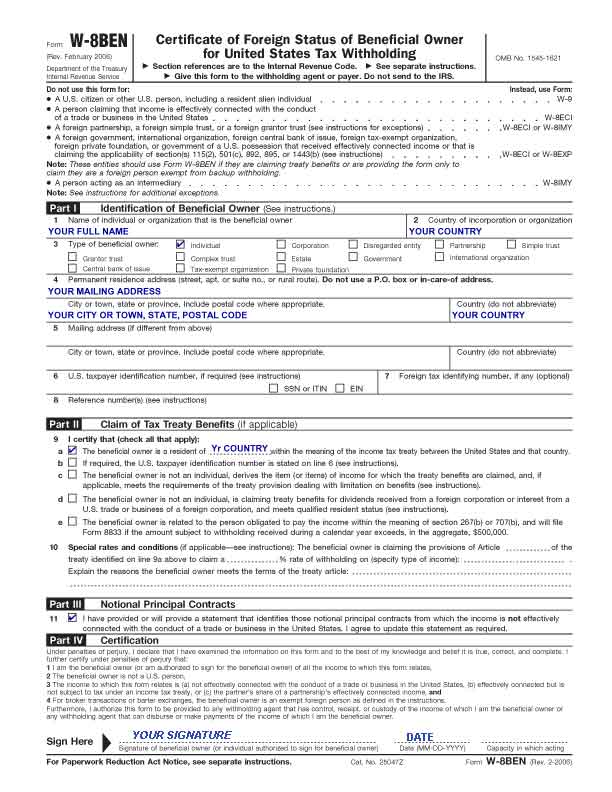

If you’re a non US citizen, and you are be required to fill up the W-8BEN form and mail or fax the form over.

So first things first, you can download the W-8BEN form at the IRS website here: http://www.irs.gov/pub/irs-pdf/fw8ben.pdf (this link allows you to SAVE the data for later FYI)

Instructions for W-8Ben located here: http://www.irs.gov/pub/irs-pdf/iw8ben.pdf

For non US citizens, there are just a few fields you need to fill, namely for :

1) Your name in full

2) Your country

3) Type of owner – if you’re an individual than tick “individual”

4) Your address

9) Tick the box [a] for “The beneficial owner is a resident of….” and input your country’s name in the empty field.

Check appendix 1. If your country is NOT on this list, do not tick this box.

Ignore the rest (b-e), as in all likelihood you and your country has no tax treaty with the United States.

11) Tick the box for -“I have provided or will provide a statement that identifies those notational principal contracts…”

Sign at the bottom and input the date (month-day-year format).

Here is a bigger picture of the form and the areas to fill; if you need to view how it is done.

Appendix 1 – List of countries with a Tax Treaty with the US

Armenia Finland Latvia Slovenia

Australia France Lithuania South Africa

Austria Georgia Luxembourg Spain

Azerbaijan Germany Mexico Sri Lanka

Bangladesh Greece Moldova Sweden

Barbados Hungary Morocco Switzerland

Belarus Iceland Netherlands Tajikistan

Belgium India New Zealand Thailand

Bulgaria Indonesia Norway Trinidad

Canada Ireland Pakistan Tunisia

China Israel Philippines Turkey

Cyprus Italy Jamaica Poland Turkmenistan

CzechRepublic Japan Portugal Ukraine

Denmark Kazakhstan Romania United Kingdom

Egypt Korea Russia Uzbekistan

Estonia Kyrgyzstan Slovak Republic Venezuela

Not its clear. It greatly helps the content publishers filling out this form.

Thank you so much!